Getting a car is just one of one of the most exciting landmarks in life, however allow's be truthful-- it can also be a little frustrating. Between choosing the right model, evaluating new versus used choices, and managing financing, it's simple to really feel shed at the same time. That's why understanding exactly how automobile financing works is essential to making wise, certain decisions when you're all set to hit the trail in your following auto or vehicle.

This guide is right here to stroll you via the ins and outs of automobile funding-- breaking down the terms, supplying real-world understanding, and assisting you prepare to browse your acquisition like a pro.

The Basics of Vehicle Financing: What You Need to Know

Funding an auto basically implies borrowing cash from a loan provider to acquire a lorry. Instead of paying the full price upfront, you make monthly payments in time. These payments include both the principal (the cost of the vehicle) and rate of interest (the cost of loaning).

Lenders generally review your credit rating, income, employment standing, and present financial obligation to identify your eligibility and interest rate. The far better your debt and economic health and wellness, the much more beneficial your loan terms are likely to be.

It might sound like a simple process-- and in lots of means, it is-- but there are plenty of choices to make along the road that can influence your long-lasting prices.

New vs. Used: Making the Right Choice for Your Budget

One of the first huge decisions you'll face is whether to fund a new or previously owned automobile. New automobiles provide that tempting display room sparkle and the latest tech, yet utilized lorries can supply major financial savings and frequently hold their worth much better over time.

Numerous chauffeurs favor used car dealership options to stretch their budget while still landing a reliable vehicle. With licensed pre-owned programs and comprehensive lorry history records offered, acquiring utilized has ended up being a far more safe and attractive course.

Your funding terms might differ between brand-new and used vehicles as well. Lenders usually use reduced rates of interest for new cars, yet because the price is higher, your regular monthly repayments could be also. Used autos might come with a little higher rates, yet the reduced car loan quantity can help keep repayments workable.

How Loan Terms Affect Your Monthly Payment

When funding a cars and truck, you'll pick the size of your funding-- typically varying from 36 to 72 months. A longer funding term means lower monthly repayments, but it likewise implies you'll pay more in interest over time.

Much shorter funding terms feature greater monthly repayments however lower total passion costs. Finding the right equilibrium depends upon your monetary goals and how much time you plan to keep the automobile.

If you're intending to trade in for a newer version in a couple of years, a shorter term could match you best. If you're going for the most budget-friendly month-to-month repayment, a longer term may be much more comfortable; just remember the long-term price.

Deposits and Trade-Ins: Lowering Your Loan Amount

A wise way to minimize your loan quantity-- and as a result your monthly payments-- is by making a strong down payment or trading in your present vehicle.

Taking down 10% to 20% of the vehicle's rate can significantly improve your lending terms. And also, a solid deposit shows loan providers you're financially liable, which can help you secure a lower rates of interest.

If you're trading in your present auto, that value goes directly towards your brand-new car purchase. Many people see a used car dealership to assess the trade-in value of their current experience, helping them spending plan more accurately for their following acquisition.

Understanding APR: What You're Really Paying

The Annual Percentage Rate (APR) is the overall price of borrowing cash-- consisting of both the rates of interest and any kind of lender costs. It's the true bottom line when comparing financing deals, and it's the number you need to pay the closest attention to.

A low APR can conserve you thousands over the life of a funding. It's worth shopping around and getting pre-approved prior to you head to the truck dealership, so you recognize precisely what you're collaborating with and can compare offers with confidence.

Your credit rating is a huge element right here. If you're not quite where you intend to be, take a couple of months to boost your credit report by paying for financial debt and making consistent settlements-- it can make a large distinction.

Leasing vs. Financing: Which is Better for You?

While this guide focuses on financing, it's worth noting that leasing is an additional alternative that could fit some purchasers. Leasing normally includes lower monthly payments and allows you to drive a brand-new auto every couple of years.

Nevertheless, you don't possess the vehicle at the end of the lease, and there are typically mileage restrictions and wear-and-tear charges. Financing, on the other hand, constructs equity-- you have the car outright once the loan is repaid.

For motorists who intend to keep their lorry for the long haul or place a lot of miles on it, financing with a respectable truck dealership is typically the even more economically audio choice.

What to Bring When You're Ready to Finance

Being prepared can quicken the financing procedure and help guarantee you obtain the very best feasible terms. When you head to the dealership, bring:

Your vehicle copyright

Evidence of insurance

Recent pay stubs or evidence of income

Evidence of residence

Credit report or pre-approval (if available)

Trade-in documents (if relevant)

Having all of this prepared makes it less complicated to assess various funding alternatives on the spot and progress with self-confidence.

Discovering Options for Chevrolet Fans

If you've got your eye on Chevrolet trucks to buy, you're not the only one. These vehicles are known for their toughness, efficiency, and value-- making them a fantastic fit for both daily drivers and severe adventurers alike.

Whether you're looking for a durable workhorse read more here or an elegant, road-ready SUV, funding alternatives can aid make your optimal Chevrolet a lot more possible. The right truck dealership will stroll you via the procedure, clarify every information, and see to it you're obtaining the offer that finest fits your life.

Funding Tips for First-Time Buyers

If this is your first time financing a vehicle, below are a couple of quick suggestions to keep in mind:

Know your credit history before you go shopping.

Set a strong budget and stay with it.

Factor in tax obligations, charges, and insurance coverage costs.

Do not be afraid to ask questions-- your convenience matters

Consider getting pre-approved for funding before visiting a used car dealership

The very first car you fund establishes the tone for your future credit rating possibilities, so take your time, stay notified, and be intentional about every action.

Stay Connected and Informed

Vehicle funding doesn't need to be complicated-- and when you're knowledgeable, it can actually be empowering. Whether you're eyeing Chevrolet trucks offer for sale, exploring funding for the very first time, or going to a truck dealership to consider your options, the process can be amazing and rewarding.

Stay tuned for more blog site updates to keep discovering and making the most intelligent automobile selections feasible. We're right here to help direct your journey-- so do not be an unfamiliar person. Come back soon and drive ahead with self-confidence.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Luke Perry Then & Now!

Luke Perry Then & Now! Ross Bagley Then & Now!

Ross Bagley Then & Now! Soleil Moon Frye Then & Now!

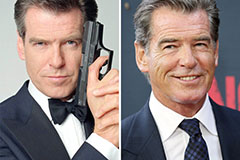

Soleil Moon Frye Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!